Investment Appraisals

Investment Appraisal for Real Estate

When investing in real estate, understanding the value and risks of your decision is crucial. Investment appraisals help investors evaluate the profitability, viability, and risks of a potential property acquisition or development project. By examining projected cash flows, operational costs, and risks, investors can make informed decisions and allocate capital more effectively. Common appraisal methods such as Net Present Value (NPV), Internal Rate of Return (IRR), and the payback period are widely used to measure a property’s financial outlook.

Why are Investment Appraisals Important?

Investment appraisals are essential for real estate investors because:

- They can make data-driven decisions.

- They can assess the risks involved in property investments, including market volatility and economic changes.

- They can compare multiple investment opportunities to identify the best option.

- They can maximize returns while minimizing risks and losses.

Key Factors to Consider

- Cash Flow Projections: Accurate cash flow forecasts are essential for assessing whether a real estate investment is financially viable. This includes estimating rental income, operating expenses, and vacancy rates.

- Risk Assessment: Real estate investments carry risks such as market fluctuations, tenant turnover, and unforeseen expenses. Understanding and evaluating these risks are crucial to successful investment.

- Time Horizon: The investment duration affects which appraisal method is most suitable. Long-term investments often benefit from NPV and IRR calculations, while shorter-term projects may rely on the payback period.

- Opportunity Cost: Investors must weigh the potential investment against alternative options to ensure the best use of their capital.

Real Estate Investment Appraisals in Practice

For real estate investors, a thorough investment appraisal is key to understanding potential returns and overall financial viability. Whether investing in residential or mixed-use properties, having an in-depth analysis helps guide smart decisions. Partnering with a professional appraisal service like Boston Appraisal Services ensures that investors receive accurate property valuations, cash flow projections, and insights into local market conditions. This provides clarity on potential returns and associated risks, making for better decision-making.

Working with professionals like Boston Appraisal Services offers thorough analysis and expert guidance, helping maximize returns in today’s real estate market. Please call our offices at 617-440-7700 or email us at orders@bostonappraisal.com, to see how we can help.

As Is – As Repaired Appraisals

As Is – As Repaired Appraisals involve determining the market value of a property in two different conditions: the current “as is” state and the projected value after renovations and repairs are made. These types of appraisals are particularly useful for properties that may need renovations or updates to meet market expectations or lender requirements. The appraiser will assess the property in its current condition and estimate what repairs or improvements are needed. This approach allows buyers, investors, and lenders to understand both the present value and the potential value of the property post-repair, providing a clearer picture for financial decision-making.

Investment Properties

Investment Properties require appraisals that focus on income generating potential, either through rental income or property appreciation. The appraisal takes into account the property’s ability to produce cash flow, including current and potential future rents, operating expenses, and any potential for capital appreciation. The appraiser also considers the condition of the property, location, and market trends to assess the overall return on investment. This type of appraisal is critical for investors, helping them evaluate the financial performance of a property and make informed decisions about purchases, financing, or sales.

Market Rent Studies

Market Rent Studies are used to determine the rental income a property can generate in the current market. These studies compare similar properties in the area, taking into account factors such as location, condition, size, and amenities. They also incorporate supply, demand, and absorption analysis, which help assess market trends. High demand with limited supply drives up rent, while an oversupply can push rents down. Absorption analysis, which looks at how quickly rental units are leased, provides valuable insights into vacancy rates and market saturation. This helps landlords, property managers, and investors set competitive rents that attract tenants while maximizing income.

For investors, market rent studies offer critical insights into a property’s income potential, cash flow forecasts, and overall investment risk. By understanding these dynamics, investors can evaluate whether a property will provide a strong return on investment (ROI) and whether the market can support future rent increases. Lenders also rely on these studies, particularly in commercial real estate, to assess if a property’s rental income will support loan repayment. In doing so, they ensure the property’s financial health aligns with current market conditions, benefiting both investors and lenders.

Highest and Best Use Analysis

A Highest and Best Use Analysis is an evaluation to determine the use of a property, analyzing whether the property’s current use is the best use, or if a different, more lucrative use can be achieved. This analysis takes into account what is legally permissible, physically possible, financially feasible, and maximally productive for the property. An appraiser will assess zoning regulations, market trends, and the property’s location to determine whether its current use or a potential alternative, such as redevelopment or conversion, would yield a higher value. This analysis can help optimize the value and utility of real estate assets.

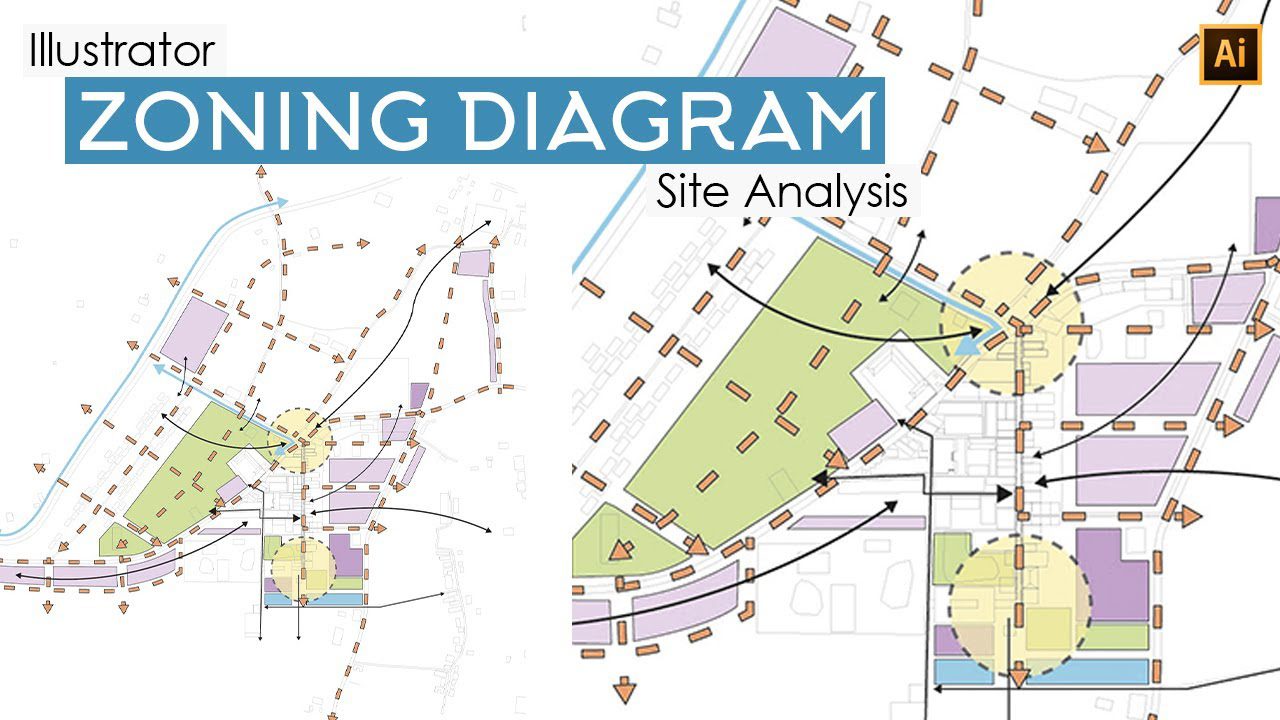

Zoning Analysis

A Zoning Analysis examines the property’s current zoning classification and how it impacts the potential uses and value of the land or building. Zoning regulations dictate how properties can be used—whether for residential, commercial, industrial, or mixed purposes. Appraisers analyze local zoning laws to determine whether a property complies with its designated use and to assess potential opportunities or limitations for future development. Zoning analyses are essential for developers, investors, and property owners considering changes in property use or expansion, as they ensure that the property aligns with the governing regulations and possible future uses.