Real estate investing is not as simple as purchasing a property and waiting for its value to appreciate over time. There are various financial concepts and metrics that investors need to understand to make informed decisions. Capitalization rates, interest rates, and yield rates are among the most critical of these concepts. Let’s dig deeper into each of these and gain a better understanding of their significance in the field of real estate.

How Capitalization Rates Affect Real Estate Valuation

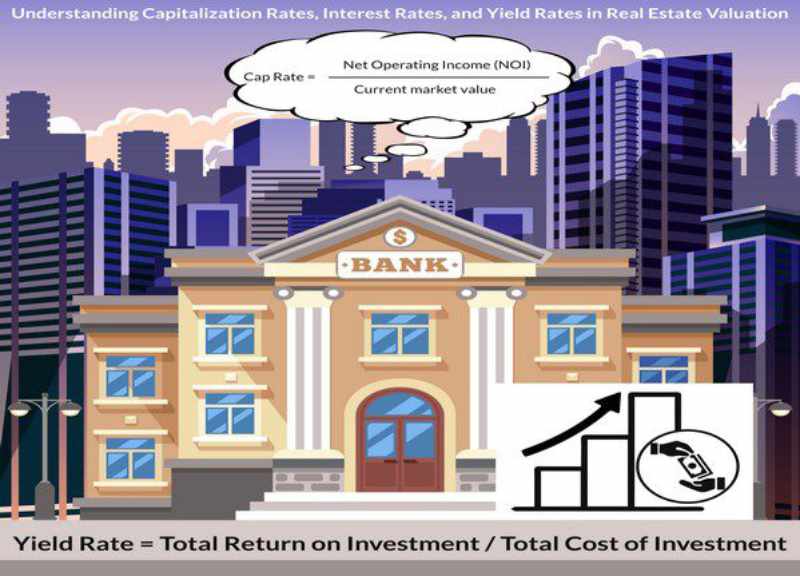

The capitalization rate, or cap rate, is a real estate valuation measure used to compare different real estate investments. It is calculated by dividing the net operating income (NOI) by the market value or purchase price of a property.

Cap Rate = Net Operating Income / Current Market Value

The cap rate offers investors a quick method to compare the relative value of different real estate investments. It measures the potential return on investment, ignoring any debt involved. Essentially, the cap rate is the ratio of the income a property is expected to generate against its total value.

A higher cap rate indicates a potentially higher risk and consequently a higher return on investment. Conversely, a lower cap rate might indicate lower risk and thus a lower return. This means the cap rate can affect the valuation of a real estate investment significantly. If a property has a cap rate that’s too high compared to similar investments, it could suggest inherent risk factors, like the possibility of lower occupancy rates or higher maintenance costs.

How Interest Rates Affect Capitalization Rates

The interest rate, as set by a central bank such as the Federal Reserve, is a significant determinant of the cap rate. The reason is simple: interest rates represent the cost of borrowing money, and when this cost fluctuates, it impacts the profitability of an investment.

When interest rates are low, investors are more willing to pay higher prices for properties, driving down the cap rates. However, if investors are able to borrow money at a lower cost, they can afford to accept a lower return on their investment, hence the lower cap rate.

Conversely, when interest rates are high, the cost of borrowing money increases. This increases the risk of investing in real estate, so investors demand a higher return for the increased risk, which results in higher cap rates. Therefore, cap rates and interest rates are indirectly proportional to each other.

Difference Between Capitalization Rates and Yield Rates

While cap rates and yield rates may seem similar, they are distinct concepts in real estate investing. We’ve already discussed cap rates, so let’s understand yield rates. A yield rate is the total return on an investment, inclusive of any changes in the value of the investment over time. It can also be considered as the annual income from an investment divided by the total cost of the investment.

A key difference between the two is that cap rates only consider the income expected in the next year, while yield rates consider the entire investment term. Yield rates also consider the changes in the property value, whether due to appreciation or depreciation.

Thus, yield rates provide a more comprehensive overview of an investment’s profitability over its life. In contrast, cap rates provide a snapshot of the potential profitability of an investment at a given moment in time.

In Conclusion: Cost of Borrowing, Interest Rates, Capitalization Rates, and Purchasing Power

To conclude, the cost of borrowing is essentially the interest rate set by the central bank, like the Federal Reserve. This interest rate not only affects the capitalization rates but also the purchasing power of investors.

When interest rates are low, the cost of borrowing decreases, which can increase the purchasing power of investors. They can borrow more for the same cost, allowing them to invest in properties with lower cap rates. Conversely, when interest rates are high, the cost of borrowing increases, reducing the purchasing power of investors, who then tend to seek properties with higher cap rates to offset the increased cost.

Understanding these concepts and their interrelation provides a robust foundation for making informed real estate investment decisions. It enables investors to assess risk and potential return, determine fair property values, and understand how changing economic conditions might affect their investments.

Given the complexities of capitalization rates, interest rates, yield rates, and their roles in property valuation, an experienced appraiser can offer invaluable guidance and support. This is where we, at Boston Appraisal Services, can be of assistance.

An appraiser’s job is to provide an unbiased, expert opinion on the value of a property. They accomplish this by thoroughly understanding the interplay of these financial metrics and the local market conditions. Having an accurate valuation is essential in real estate transactions to ensure that the price being paid for a property is fair and reflective of its true value.

Boston Appraisal Services is a leading real estate appraisal company that specializes in complex commercial and residential appraisals. Our appraisers have the expertise to help clients navigate the ever-changing Boston real estate market. We offer a comprehensive range of services to meet all your appraisal needs, from single-family homes to multi-million-dollar commercial properties. Whether you are an expert investor, a first-time homebuyer, or a business owner, our team can provide you with a precise, reliable appraisal that you can use to make confident real estate decisions.